May 16, 2023, | Author: Parthasarathy Vijayaraghavan

This article explains the compelling need for any financial institution in digitizing its consumer lending business and provides key insights on developing a digital transformation program including its challenges, options, and benefits. It also highlights the importance of developing a digital strategy for the successful implementation of a digital lending business.

I. SCOPE OF THIS PAPER

| Transformation Focus | On achieving efficiency and speed by process automation and optimization through digital technology enablement. | |

| Financial Institutions | Banks and Credit Unions | |

| Business | Consumer Lending (CL) | |

| Region | North America (NA) | |

| Product Type | Secured Loans Housing Loans Loan on Property Auto Loans | Unsecured Loans Personal Loans Educational Loans Credit Card Loans |

II. INTRODUCTION

Currently, both traditional and non-traditional lending organizations offer a variety of consumer loan products to their customers depending on their needs. Though the fundamentals and structure of various loans remain the same, operationally they need to be managed differently based on their product category and regulatory implications. This makes the organizations manage business functions that are non-standard and complex across product lines. The consumer lending business encompasses various activities which enable banks and credit unions to deliver a variety of lending products to its customers and members. Some of the key activities are listed below:

CORE FUNCTIONS:

- Loan Origination: Process to collect financial and non-financial data from potential customers and evaluate those data against the credit norms and policies followed by credit decisions and approvals.

- Loan Management: Process that manages the servicing of loans including intimation of demand, total outstanding, collection of EMIs, customer /member communications, and handling requests.

- Loan Closure: Process to manage normal and pre closures. This also includes refinancing and Secondary marketing of assets.

SUPPORTING FUNCTIONS:

- Document Management: Supports collection and management of data. Also enables storing and retrieval of documents and images throughout the customer journey.

- Complaint Management: Supports logging queries or issues from the customer side. Also enables the organization to communicate the details of query resolution.

- Regulatory and Compliance: Supports adherence to internal and external regulatory requirements and helps to generate accurate regulatory reporting.

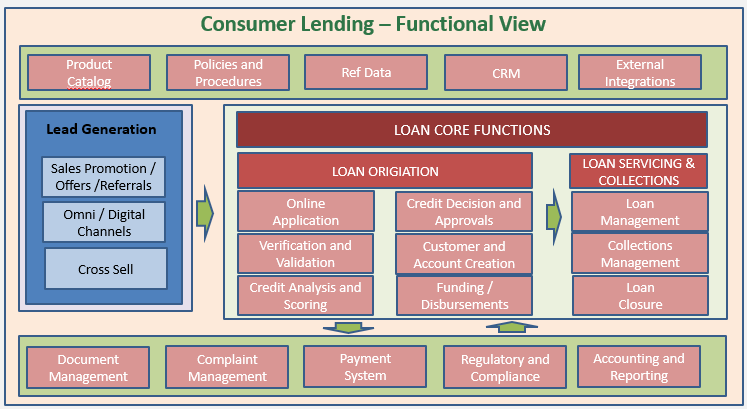

The representation below depicts the key business functions with which the consumer lending business operates and interacts:

III. INDUSTRY SNAPSHOT

Global View on Consumer Lending Business: Consumer lending, offered by financial institutions, has grown multifold in the past few decades. It is estimated that the global consumer finance market size stood at USD 1,221.38 billion in 2022. It is further expected to grow at an impressive CAGR of 7.07% reaching a value of USD 1,958.62 billion by 2029.

NA Consumer Lending Market View: ‘North America dominates the global consumer finance market. According to simply wall street, the American consumer finance industry has registered 4.0% growth per year over the last three years and the companies have witnessed 8.8% revenue growth per year.’

IV. WHY DIGITAL?

Digital transformation is the process in which financial organizations implant technologies across their businesses to drive fundamental changes. FIs leverage core technologies of cloud, big data/analytics, mobility, and social media to manage relationships and conduct business transactions more successfully. Some of the key outcomes of digital enablement can:

- Improve speed and increase efficiency,

- Provide greater business agility and,

- Offer new experiences for customers, members, employees, and other stakeholders.

Considering the existence of the Technology division as a cost center is no longer a valid proposition. Technology has taken a key role as a value driver for business development. Today, businesses are deeply impacted and driven by technology. As a result, IT automation and digital transformations are considered as an integral part of business, to drive operations at speed and to manage a high volume of business transactions resulting from a growing customer/member base. Moreover, repetitive and mundane activities are effortlessly done through digitization which improves productivity significantly. Technology also manages complex and intricate business scenarios more effectively by well thought through digital solutions and innovations. Besides well-executed business plans, technology has become a critical component of success for business. The following are some of the key tenets which drive digital lending:

- Reduce the application processing and decision-making time to maintain competitive Turn Around Time (TAT)

- Support multiple channels and integrate them to offer the omnichannel experience to borrowers.

- Manage growing volumes at speed and consistency.

- Meet the expectations of borrowers by providing a frictionless digital journey.

- Improve overall customer/member experience.

- Adhere to internal norms, policies, and procedures through automation and digitization.

- Ensure efficient realization of loan operations’ functions and meeting of required operational KPIs

- Follow-up member /customer queries and complaints to provide quick resolution.

- Provide a seamless platform experience by integrating key support functions.

- Execute all business functions with ease.

The below table shows the current position of Banks and Credit Unions in their digital adoption:

| Area of Digitization | Driver | Banks | Credit Unions |

| Loan Origination | Labor is intense and time-consuming | High | Low and Medium |

| Servicing and Collections | Lack of integration with core systems Labor Intense and recon issues | High | Low and Medium |

| Document Management | Physical storage and delay in retrieval | High | Low and Medium |

| Customer Complaints | Delayed resolutions | High | Low and Medium |

| Regulatory | Inaccurate manual reports | Medium | Low and Medium |

V. KEY CHALLENGES IN DIGITAL TRANSFORMATION

Automating and Digitizing business functions end to end requires a well-thought-out plan and commitment from the organization to make it a success. Organizations embarking on a digital journey might undergo the following challenges:

- Data flowing in from discrete systems.

- Non-standard business processes across product lines

- Non-value-added activities are present in the process flow

- Digital culture prevails at a minimum.

- Complex regulatory requirements call for manual processes. (like physical appearance/ signatures)

VI. TRANSFORMATION OPTIONS AND ANALYSIS

Digital transformation initiatives are aimed at achieving a higher level of productivity, reducing costs, and improving customer experiences. To successfully implement a digital program, it is imperative to identify the organization’s digital goals and borrowers’ expectations with a well-developed roadmap. It is also critical to align the organization and customers’ expectations with business strategy and current technology framework, to decide on the most suitable options for executing digital transformation.

Listed below are some of the key transformation options:

OPTIONS ANALYSIS SUMMARY

| Key Parameters / Options | Green Field | Off The Shelf Solutions | Fintech | Hybrid |

| Approach | MVP | Modular | Modular | MVP |

| Functional and Tech fit | Best Fit | Good Fit | Best Fit | Good Fit |

| Risk | High | Low | Low | Medium |

| Time to Market | Medium | Fast | Rapid | Medium |

| Cost | High | High | Moderate | Moderate |

| ROI | Staggered | Immediate | Immediate | Quick |

*NOTE:

- MVP refers to Minimum Viable Product

- The scope of transformation for the above analysis is restricted to consumer lending

- We recommend a detailed digital readiness assessment specific to organizations to identify a suitable option.

VII. KEY BENEFITS OF DIGITAL LENDING

Digital transformation and automation remove silos prevalent across multiple systems and move towards a unified single digital platform. It empowers businesses to manage end-to-end business processes and respond quickly to industry shifts. Also acts as an enabler to increase organizational efficiency and minimize errors to gain a competitive advantage. Following are the key benefits of digitization.

- Approve loans quickly with industry-benchmarked timelines (TAT)

- Enhance customer/member onboarding experience.

- Enable multiple channels to deliver customer experience at speed.

- Improve employee experience by automating mundane and repetitive activities.

- Better customer relationship management by handling customer queries swiftly.

- Adherence to regulation by integrating compliance needs with the core business.

- Achieve operational efficiency through standard and streamlined processes even at high volume levels.

- Realizing credit insights through predictive analytics

- It empowers businesses to streamline compliance-related workflows, such as risk assessments, control evaluations, testing, and corrective action planning.

VIII. DEVELOPING A SUCCESSFUL DIGITAL STRATEGY AND PLAN

It is imperative to have a well thought digital strategy to achieve the expected business and technology transition. Digital engagements conceived with a fragile plan of action do not produce impressive outcomes. It deeply impacts business and technology roadmap and ROI. Ineffective transformation may also affect digital adoption within and outside the organization. Hence a detailed digital strategy is of paramount importance to realize impactful results.

Following are the few key principles that may help to have a well thought digital strategy.

- An Enterprise-wide approach must be taken to realign business strategy and operations to formulate a technology-led digital transformation program.

- Vision for digital must be in alignment with business vision and technology priorities.

- Digital readiness assessment comprehending current digital status, culture, and expected adoption level can help formulate a more meaningful strategy.

- Industry maturity benchmarking on digital adoption could be a driver to decide on digital priorities and baseline realistic expectations.

- The digital program roadmap should be structured very well to align with realizable ROIs to manage the cost to be incurred on transformation.

- Customer /member acceptance is the key to success. Hence a well-structured digital implementation plan aligned with customer /member expectations would increase adoption significantly.

- Implementing an Organization Change Management (OCM) is the key to enhancing the adoption and embracing the change.

IX. HOW CAN TEMPLAR SHIELD BE A STRATEGIC PARTNER IN YOUR DIGITAL JOURNEY?

Templar Shield (TS) has a team of strong business and technology consultants with deep experience in implementing digital transformation Programs in the BFS domain. The right mix of domain and technology capabilities available with TS would be a success factor in your digital journey to transform your lending platform.

TS can help Financial Institutions such as banks and credit unions in their digital journey to:

- Formulate a new digital strategy to transform and enhance your loan offerings along with technology vision and priorities.

- Conduct a digital maturity assessment of your core lending platform and operations to evaluate the digital adoption levels.

- Support end-to-end digital transition program to enable your business to transition from a legacy lending platform to a digital lending platform to drive better decisions and improve productivity.

- Conduct a current status assessment by analyzing your technology challenges to provide specific digital solutions to enhance your offerings.

- Streamline your business process to enable a smooth digital transition.

- Provide consulting and implementation of GRC systems and integrate with your lending platforms to enhance regulatory adherence and improve the accuracy of GRC reporting.

- Recommend product platform shortlisting and selection that suits your digital needs. (Including RFP preparation)

- Support implementation, customization, and integration of third-party digital platforms

- Provide change management and training to improve digital adoption

X. SAMPLE DIGITAL USE CASES

| Use Case 1 | Digital Loan Underwriting | |

| Process Area | Loan Origination | |

| Key Steps Involved | Key Benefits | |

| 1. Digitize loan applications for data collection. 2. Enable omni channel support for communication. 3. Automate verification and validations 4. Workflow-based evaluation of application based on organization credit policies 5. Online approvals and disbursements | 1. Negligible / no manual process. 2. Better risk profiling due to automation 3. Faster decision making 4. Managing a higher volume of transactions at ease 5. Flexibility in choosing product lines 6. Enhanced customer /member journey | |

| Use Case 2 | Modernize Image and Content Services | |

| Process Area | Document Management | |

| Key Steps Involved | Key Benefits | |

| 1. Enable uploading and downloading all relevant loan details and documents across modules, systems, and platforms. 2. Manage customer/member data collection, and extraction, through digital content. 3. Build secure access and control over customer/member data. 4. Integrate document management system with the core lending platform. | 1. Physical documents minimized. 2. Electronic loan files 3. Verification is done easily as documents are centralized and can be retrieved at ease. 4. Repeated document requests are avoided. 5. Loan agreement generation at ease | |

| Use Case 3 | Speed up Customer / Member Query resolution | |

| Process Area | Compliant Management | |

| Key Steps Involved | Key Benefits | |

| 1. Implement self-service modules to reduce resolution time and improve efficiency. 2. Enable multi-channel support. 3. Deliver proactive response service to reduce issues through exception reports. 4. Construct an actionable dashboard to prioritize and resolve the issues. 5. Build workflows to enable agents to assist customer queries. 6. Integrate the complaint management system with the core lending platform. | 1. Most of the customers / members gets what they want through well-implemented self-service portals. 2. Omni channels unveils the benefit of multiple channels / social media platform to provide better customer experience. 3. Faster resolution of issues resulting in better customer satisfaction | |

| Use Case 4 | Enhance Regulatory and Compliance adherence | |

| Process Area | GRC | |

| Key Steps Involved | Key Benefits | |

| 1. Define regulations, governance and compliance and its applicability to automate and digitize. 2. Define internal policies and procedures and their applicability to automate and digitize. 3. Build and position an IT framework to govern GRC requirements. 4. Construct an actionable dashboard to identify and report exceptions. 5. Build alert/notification systems to improve visibility of risk at various levels. 6. Integrate GRC platforms with core lending platforms to enable seamless adoption to regulations and compliance | 1. Imbibes system with internal check and controls. 2. Improves visibility of risk 3. Enables quick remedial action to mitigate financial and non-financial impact arising out of risk. 4. Enhances adherence to compliance. 5. Fulfillment of internal policies and procedures | |

ABOUT AUTHOR

Parthasarathy Vijayaraghavan (Partha), is a managing consultant with a templar shield from Financial Services Operations (FSO) practice. He is a proficient IT consultant in the BFS domain with 25 years of experience. Partha has worked on several IT engagements as a functional consultant for various clients in the banking and finance industry across geographies.

This includes program management, digital transformation initiatives, process automation, business architecture, IT application rationalization, solutioning, and re-engineering of legacy platforms. His domain competencies include cards and payments, retail and corporate banking, consumer and commercial lending, finance, and accounting. He can be reached at parthasarathy.vijayaraghavan@templarshield.com